After I got back my 80% Japan pension, I procrastinated until my friend gave me an ultimatum, she would proceed with the 20% tax refund application and not waited for me. So, I found all the necessary documents and proceeded to apply for the remainder 20% of the pension that was deducted as the tax when I applied for the Japan Pension lump sum withdrawer.

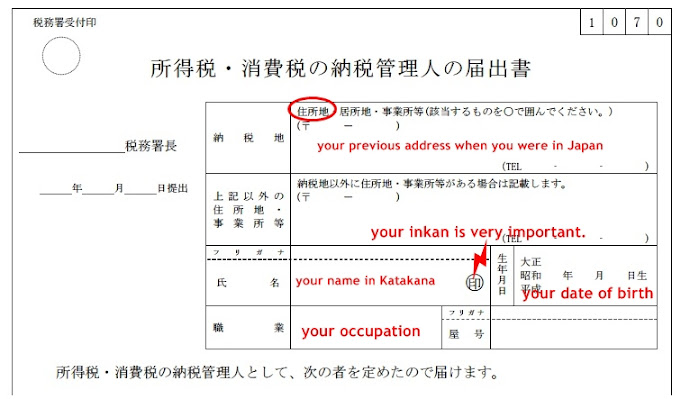

First of all, one needed to find a willing friend or colleague to be the tax representative. I have a colleague in the area that I stayed in Japan before I came back to Malaysia*. The form here is needed to tell the tax office that one is appointing the person as one's tax representative 納税管理人. Just print out the first page and fill up the necessary items, the second page is not important.

| form to appoint the tax representative |

*To claim back this 20% tax refund, one needs to go back to the local tax office to submit the document. So, it's better to appoint a local person as the tax representative. My own assumption though, not sure true or not.

To fill up this form, the most important part was the date one left Japan. A colleague filled up the wrong date and her tax representative had to go to the tax office again to correct the item. So, beware! I remembered the date wrongly also, luckily I double checked with the stamping date on my passport. Just make sure to fill up everything correctly to avoid increasing the burden of the tax representative.

|

| The details of the applicant |

|

| the details of the applicant and the tax representative and the most important item is the date one left Japan |

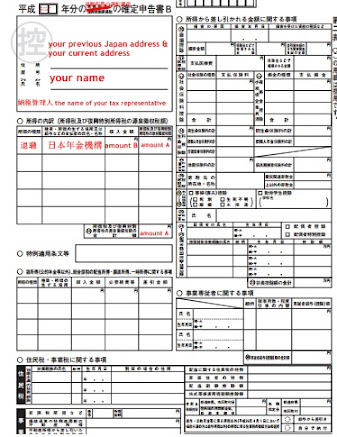

After filling up the form to appoint a tax representative, one needs to fill up the income tax form (I took one hard copy from the local tax office before I left Japan), however, I found out that there's a link for the income tax form here. Anyway, the format was not same with the one I got from the tax office three years ago. So, this is just my own experience, anything please call the Japan tax office. Or one could just appoint a professional company to get back the tax refund. ex: here and there.

For the 所得税の申告書B, cross the 所得税 and change to 退職所得の選択課税 . Then fill up the details. For 源泉徴収税額, the amount to fill in is the amount of tax deducted from the lump sum withdrawer, I called it "amount A" here, the exact amount can be found at the notice of entitlement: your lump-sum withdrawer payments by National Pension / Employees' Pension Insurance. For 申告納税額 and 還付される税金, also "amount A".

For the 所得税の申告書B, cross the 所得税 and change to 退職所得の選択課税 . Then fill up the details. For 源泉徴収税額, the amount to fill in is the amount of tax deducted from the lump sum withdrawer, I called it "amount A" here, the exact amount can be found at the notice of entitlement: your lump-sum withdrawer payments by National Pension / Employees' Pension Insurance. For 申告納税額 and 還付される税金, also "amount A".

|

| example on how to fill up the income tax form |

For the 所得税の確定申告書B, cross the 所得税 and change to 退職所得の選択課税 too. Then, fill up the personal details. For the table of 所得の内訳(源泉徴収税額). Fill the details as below.

| 所得の種類 | 種目.所得の生ずる場所...... | 収入金額 | 源泉徴収税額 |

|---|---|---|---|

退職

|

日本年金機構

|

amount B

|

amount A

|

|

| example on how to fill up the income tax form |

For the 所得税の申告書(分離課税用), I couldn't find this sheet on the latest form. So, maybe it's no longer needed. Anyway, nothing much to fill in this sheet also, only the part where I filled up the total pension amount and some other personal details.

Anyway, this tax refund was faster than the lump sum withdrawer, I got it less than three months after my friend helped to apply it.

****THIS IS JUST BASED ON MY OWN EXPERIENCE, ANY DETAILS PLEASE REFER TO THE TAX OFFICE OR RELATED PIC.

Hi,

ReplyDeleteA huge thank you for explaining the form and the process so well!

I was just wondering if it's okay to fill this form in English?

i have no info for this. based on my own experiences, as well as my colleagues experiences, we all filled up the form in japanese

DeleteMillion thanks for your post! You're the best!

ReplyDelete